If you happen to be viewing the article The simple interest on a certain sum for 3 years in Rs. 225 and the compound interest on the same sum for 2 years is Rs. 165. Find the rate percent per annum. ? on the website Math Hello Kitty, there are a couple of convenient ways for you to navigate through the content. You have the option to simply scroll down and leisurely read each section at your own pace. Alternatively, if you’re in a rush or looking for specific information, you can swiftly click on the table of contents provided. This will instantly direct you to the exact section that contains the information you need most urgently.

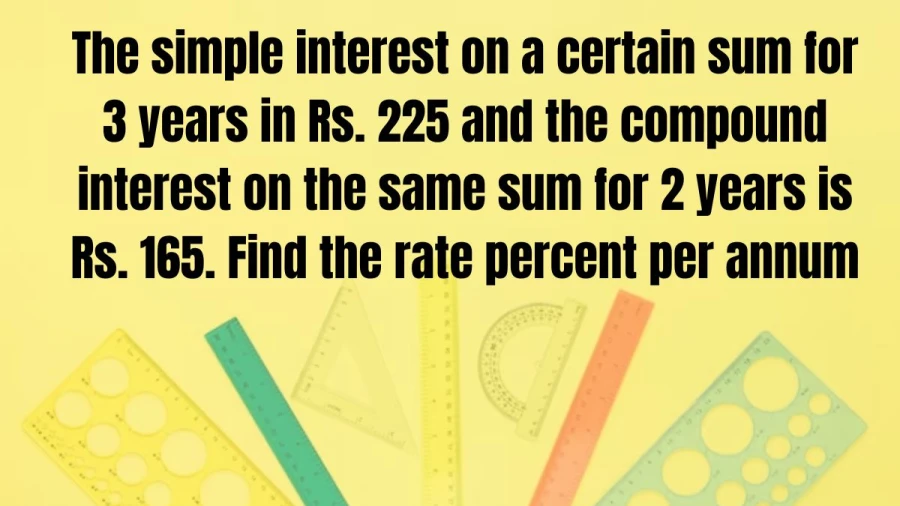

The Simple interest on a certain sum for 3 years in Rs. 225 and the compound interest on the same sum for 2 years is Rs. 165. Find the rate percent per annum.

The rate of interest per annum is 20%.

Given:

- Simple Interest (SI) for 3 years = Rs. 225

We find that the SI for 1 year is 225/3 = Rs. 75.

Since the compound interest for the second year is Rs. 90, and the simple interest for the second year is Rs. 75, the difference between compound interest and simple interest for the second year is 90 – 75 = Rs. 15.

Article continues below advertisement

Now, to find the rate of interest:

Rate of interest = (Difference / Simple interest for 1 year) * 100

= (15 / 75) * 100

= 0.20 * 100

= 20%

So, the rate of interest per annum is 20%.

Simple vs. Compound Interest: Understanding the Difference

Both simple interest and compound interest are ways to calculate the interest earned on money over time, but they differ in how they account for that growth:

Article continues below advertisement

Article continues below advertisement

Simple Interest:

- Calculated only on the initial principal amount (the original amount borrowed or invested).

- Interest earned in each period remains constant throughout the investment or loan term.

- Often used for short-term loans or investments, where the compounding effect is minimal.

Formula:

Simple Interest (SI) = Principal (P) x Rate (R) x Time (T) / 100

Compound Interest:

- Takes into account both the principal amount and the accumulated interest from previous periods. This is often referred to as “interest on interest.”

- Interest earned grows exponentially over time, leading to a faster growth in the overall amount compared to simple interest.

- Used for long-term investments and loans, where the compounding effect can significantly increase the final amount.

Formula:

Amount = Principal (P) x (1 + Rate (R) / Number of compounding periods (n))^ (Time (T) x n)

Here’s an example to illustrate the difference:

Let’s say you invest $1000 for 5 years at a 10% annual interest rate.

- Simple Interest:

- SI = 1000 x 10 x 5 / 100 = $500

- Total amount after 5 years: $1000 (principal) + $500 (interest) = $1500

- Compound Interest:

- Assuming annual compounding:

- Amount = 1000 (1 + 0.1)^5 = $1638.62

- The difference highlights the power of compound interest over time.

- Assuming annual compounding:

Thank you so much for taking the time to read the article titled The simple interest on a certain sum for 3 years in Rs. 225 and the compound interest on the same sum for 2 years is Rs. 165. Find the rate percent per annum. written by Math Hello Kitty. Your support means a lot to us! We are glad that you found this article useful. If you have any feedback or thoughts, we would love to hear from you. Don’t forget to leave a comment and review on our website to help introduce it to others. Once again, we sincerely appreciate your support and thank you for being a valued reader!

Source: Math Hello Kitty

Categories: Math