If you happen to be viewing the article What should be the selling price to gain 10% If the vendor sells oranges at Rs. 2112 and loses 12%? ? on the website Math Hello Kitty, there are a couple of convenient ways for you to navigate through the content. You have the option to simply scroll down and leisurely read each section at your own pace. Alternatively, if you’re in a rush or looking for specific information, you can swiftly click on the table of contents provided. This will instantly direct you to the exact section that contains the information you need most urgently.

Find out how much to sell oranges for to make a 10% profit after initially selling them for Rs. 2112 and losing 12%.

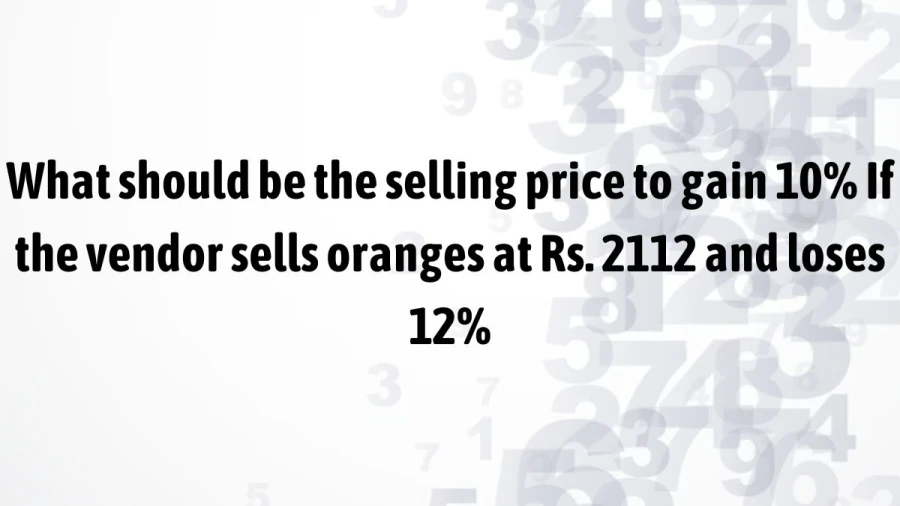

What should be the selling price to gain 10% If the vendor sells oranges at Rs. 2112 and loses 12%?

To find the selling price that would result in a 10% gain after initially selling at Rs. 2112 with a 12% loss, we can use the following steps:

-

Calculate the cost price (CP) using the given selling price (SP) and loss percentage (LP): CP = SP / (1 – LP/100)

-

Calculate the new selling price (SP_new) for a 10% gain from the cost price: SP_new = CP * (1 + 10/100)

Let’s compute:

-

Calculate the cost price: CP = 2112 / (1 – 12/100) = 2112 / (1 – 0.12) = 2112 / 0.88 ≈ Rs. 2400

-

Calculate the new selling price for a 10% gain: SP_new = 2400 * (1 + 10/100) = 2400 * 1.10 = Rs. 2640

So, the selling price to gain 10% after initially selling at Rs. 2112 and incurring a 12% loss should be approximately Rs. 2640.

Profit and Loss in Mathematics

In mathematics, profit and loss refer to the financial outcomes of a business transaction or operation. Profit is the positive financial gain earned when the revenue earned from selling a product or providing a service exceeds the total costs incurred in producing or providing that product or service. On the other hand, loss occurs when the costs exceed the revenue.

To calculate profit or loss, you typically need to consider several factors:

-

Revenue: This is the total amount of money earned from selling goods or services.

-

Costs: Costs are the expenses incurred in producing or providing goods or services. This includes direct costs such as the cost of goods sold (COGS), as well as indirect costs such as rent, utilities, salaries, and marketing expenses.

-

Profit: Profit is the difference between revenue and costs. It represents the financial gain earned by a business.

-

Loss: Loss occurs when the costs exceed the revenue. It represents a negative financial outcome for a business.

The formulas for calculating profit and loss are as follows:

Profit = Revenue – Costs

Loss = Costs – Revenue

In practice, profit and loss calculations can be more complex, especially in situations where there are multiple revenue streams or various types of costs involved. Additionally, businesses often analyze profitability using metrics such as gross profit margin, net profit margin, and operating profit margin, which provide insights into the efficiency and profitability of the business operations.

Thank you so much for taking the time to read the article titled What should be the selling price to gain 10% If the vendor sells oranges at Rs. 2112 and loses 12%? written by Math Hello Kitty. Your support means a lot to us! We are glad that you found this article useful. If you have any feedback or thoughts, we would love to hear from you. Don’t forget to leave a comment and review on our website to help introduce it to others. Once again, we sincerely appreciate your support and thank you for being a valued reader!

Source: Math Hello Kitty

Categories: Math